The GBP/USD currency pair showed absolutely no desire to move south on Thursday. The results of the Fed meeting on Wednesday evening could have influenced the pair's movement on Thursday, but they did not. Thus, for the first time in a long while, the market's reaction to such an important event was practically nonexistent. On Thursday, there were no significant events in either the UK or the US. Donald Trump did not fire anyone, did not launch new military operations, and did not threaten to impose new tariffs or stage a coup in a neighboring country. Therefore, the market had practically nothing to react to during the day. However, this situation may not last long...

This Sunday may see the start of the second "shutdown" in the last six months in America. This time, Democrats and Republicans cannot agree on funding for the Immigration and Customs Enforcement (ICE), which Trump has decided to allocate $10 billion. Recall that just in January, federal agents from this agency shot two Americans, causing widespread public outcry. Consequently, Democrats are demanding that funding for ICE be excluded from the overall budget, increasing accountability for agents regarding violations and crimes, and tightening oversight of the agency. Naturally, Trump opposes such an initiative, and regarding the two killings of civilians, he has already stated that federal agents acted in self-defense. However, numerous videos online show that this is not the case.

Meanwhile, markets are pricing in a 77% probability of a new "shutdown." Recall that last autumn, the US dollar hardly reacted to the government shutdown over political disagreements, but we noted back then that this was a completely illogical market response. In other words, alongside all the problems facing the US dollar, a "shutdown" has now been added to the mix. The market will not always be as favorably inclined towards the dollar as it was last autumn. This week, Donald Trump has openly stated that the current dollar exchange rate is great, and if it falls even lower, it will only benefit the US economy. Trump continues to fantasize about reducing the trade deficit and, instead of developing industry, manufacturing, and domestic demand, is trying to lure American companies back to the US while forcing trading partners to invest in the US economy and purchase goods and raw materials worth hundreds of billions of dollars, as well as imposing crazy tariffs to lower import levels.

By the way, the trade balance deficit in the US has indeed decreased from -$136 billion last March to -$29 billion last October. That is a decrease of about $107 billion. Of that, approximately $90 billion is attributed to reduced imports. In other words, the trade balance is improving not because America is exporting more, but because it is importing less. However, for some reason, the market is not optimistic about this and continues to shed US currency fervently. This, again, is very profitable for Trump. However, we are primarily interested in the dollar, not the US economy, so we draw a clear conclusion: the decline of the American currency will continue.

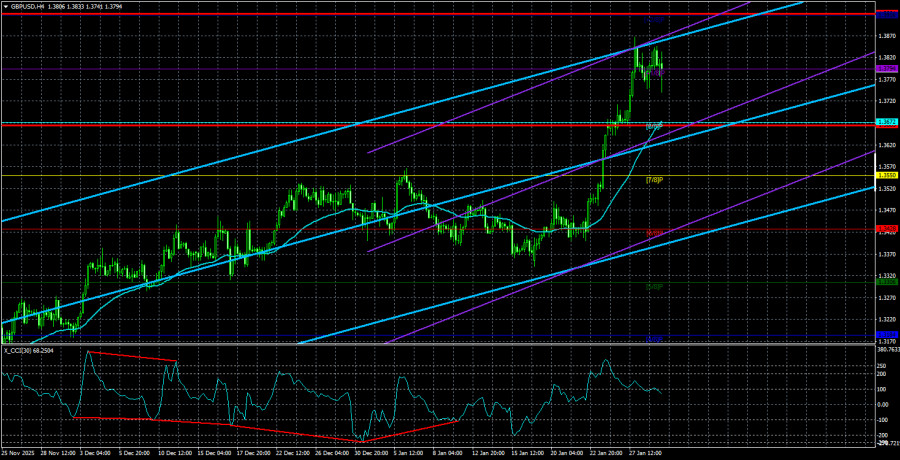

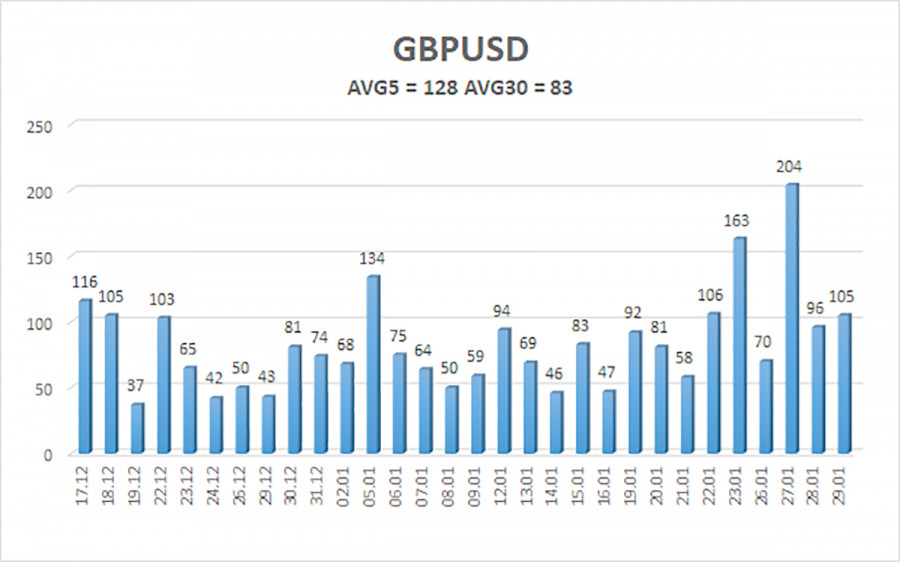

The average volatility of the GBP/USD pair over the last 5 trading days is 128 pips, which is considered "high." Therefore, we expect the pair to move within the range limited by the levels of 1.3665 and 1.3921 on Friday. The upper linear regression channel is directed upward, indicating a recovery of the trend. The CCI indicator has entered the overbought area 6 times in recent months and has formed numerous "bullish" divergences, consistently warning traders of an impending resumption of the upward trend. The entrance into the overbought area indicates a correction.

Nearest support levels:

S1 – 1.3672

S2 – 1.3550

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3794

R2 – 1.3916

Trading Recommendations:

The GBP/USD pair is on the verge of resuming the 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "reserve currency" no longer matters to traders. Thus, long positions with targets at 1.3916 and 1.3921 remain relevant in the near term while the price remains above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3550 on technical (correctional) grounds. Occasionally, the American currency shows corrections (on a global scale), but for trend growth, it needs global positive factors.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in one way, the trend is currently strong;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are target levels for movements and corrections;

- Volatility levels (red lines) indicate the probable price channel in which the pair will operate for the next day, based on current volatility indicators;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.