Analyse des Transactions du Jeudi

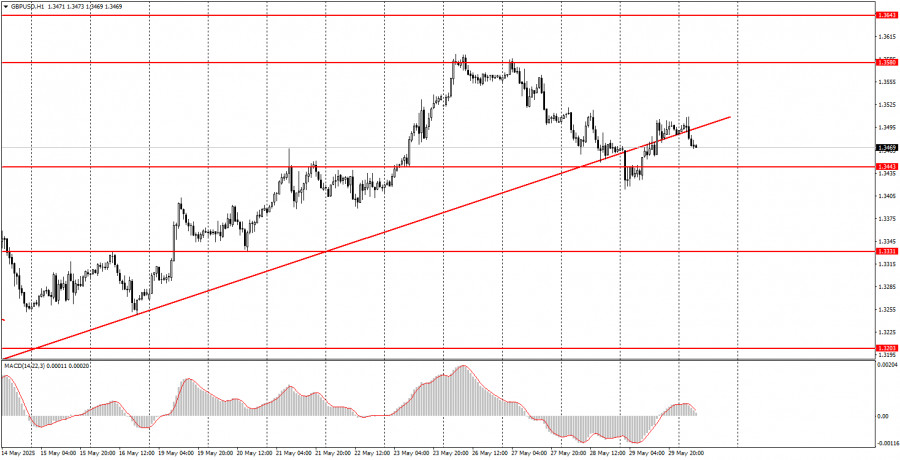

Graphique 1H du GBP/USD

Jeudi, la paire GBP/USD a montré des mouvements similaires à la paire EUR/USD mais avec une volatilité moindre. La ligne de tendance ascendante a été rompue, donc d'un point de vue technique, une nouvelle baisse de la paire et un renforcement du dollar devraient être envisagés. Y a-t-il des raisons fondamentales à cela ? C'est une question difficile car le marché continue d'ignorer de nombreux facteurs favorables au dollar américain. Hier, il a été annoncé que le tribunal avait suspendu les tarifs douaniers de Donald Trump contre la moitié des pays du monde, mais dans la soirée, le tribunal avait également suspendu sa décision de lever les tarifs de Trump. Ainsi, la situation avec la Guerre Commerciale Mondiale n'a pas changé. À partir des niveaux actuels, le dollar peut également continuer de baisser puisqu'il n'en faut pas beaucoup pour cela à l'heure actuelle. Il est préférable de se fier aux signaux techniques et aux configurations car il est extrêmement difficile de comprendre quelle direction le marché préfère.

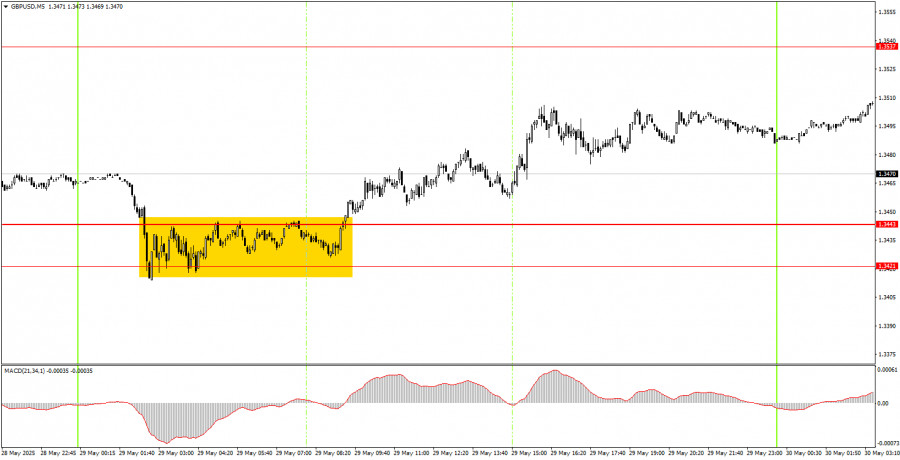

Graphique 5M de GBP/USD

Jeudi, un bon signal de trading a été généré dans le cadre temporel de 5 minutes. Au début de la séance de trading européenne, le prix a franchi la zone de 1,3421–1,3443, permettant ainsi aux traders débutants de prendre des positions longues. La livre sterling a continué de progresser durant le reste de la journée, bien que de manière modérée. Elle n'a pas atteint l'objectif le plus proche, donc la position longue aurait pu être clôturée manuellement dans la soirée.

Stratégie de Trading pour Vendredi :

Dans le cadre temporel horaire, la paire GBP/USD continue de suivre les développements autour de Donald Trump et reste assez sceptique quant à ses politiques. Quelques signes d'apaisement des tensions commerciales sont présents, mais le marché ne ressent pas une vague d'optimisme à ce sujet. Le dollar s'est renforcé cette semaine, mais il s'agit simplement d'une correction technique qui pourrait se poursuivre. Nous ne prendrions pas le risque de déclarer une tendance affirmée du dollar même après avoir franchi la ligne de tendance.

La paire GBP/USD pourrait reprendre son mouvement baissier vendredi puisque la ligne de tendance a été rompue. Cependant, peu de facteurs fondamentaux soutiennent un tel mouvement. Nous restons sceptiques quant à la croissance du dollar, mais pour le moment, il vaut mieux trader en se basant sur des facteurs techniques.

Pour le cadre temporel de 5 minutes, les niveaux de trading à considérer sont 1,2913, 1,2980–1,2993, 1,3043, 1,3102–1,3107, 1,3203–1,3211, 1,3259, 1,3329–1,3331, 1,3421–1,3443, 1,3537, 1,3580–1,3592, 1,3652–1,3660, et 1,3695.

Aucun événement significatif n'est prévu pour vendredi au Royaume-Uni, et aux États-Unis, les rapports sur le revenu et la dépense personnelle, l'indice des prix PCE et l'indice de confiance des consommateurs de l'Université du Michigan seront publiés. Nous ne pensons pas que ces rapports provoqueront une réaction marquée du marché.

Règles Fondamentales du Système de Trading :

- Force du Signal : Plus le délai de formation d'un signal (rebond ou cassure) est court, plus le signal est fort.

- Faux Signaux : Si deux transactions ou plus proches d'un niveau résultent en de faux signaux, les signaux suivants de ce niveau doivent être ignorés.

- Marchés à Plat : Dans des conditions de plat, les paires peuvent générer de nombreux faux signaux ou aucun. Il est préférable d'arrêter de trader aux premiers signes de marché plat.

- Heures de Trading : Ouvrez des transactions entre le début de la séance européenne et le milieu de la séance américaine, puis clôturez toutes les transactions manuellement.

- Signaux MACD : Sur le cadre temporel horaire, tradez les signaux MACD uniquement pendant des périodes de bonne volatilité et une tendance claire confirmée par des lignes ou des canaux de tendance.

- Niveaux Proches : Si deux niveaux sont trop proches (5–20 pips d'écart), traitez-les comme une zone de support ou de résistance.

- Stop Loss : Placez un Stop Loss à zéro après que le prix ait évolué de 20 pips dans la direction souhaitée.

Éléments Clés du Graphique :

Niveaux de Support et de Résistance : Ce sont des niveaux cibles pour ouvrir ou clôturer des positions et peuvent également servir de points pour placer des ordres Take Profit.

Lignes Rouges : Canaux ou lignes de tendance indiquant la tendance actuelle et la direction préférée pour trader.

Indicateur MACD (14,22,3) : Un histogramme et une ligne de signal utilisés comme source complémentaire de signaux de trading.

Événements Importants et Rapports : Présents dans le calendrier économique, ils peuvent influencer fortement les mouvements de prix. Soyez prudent ou sortez du marché lors de leur publication pour éviter des retournements brusques.

Les débutants en trading Forex doivent se rappeler que toutes les transactions ne seront pas rentables. Développer une stratégie claire et pratiquer une bonne gestion de l'argent sont essentiels pour réussir à long terme dans le trading.