The EUR/USD currency pair traded with a downward bias throughout Tuesday. We have repeatedly stated that the U.S. dollar doesn't require daily catalysts or triggers to continue its decline. The fundamental backdrop for the dollar is driven primarily by politics and geopolitics. The market consistently ignores other news, factors, and topics. For example, traders continue to ignore the Federal Reserve's monetary policy, which remains hawkish, yet this doesn't stop the dollar from depreciating. Meanwhile, the European Central Bank and the Bank of England continue cutting their key interest rates — a trend that should, under normal circumstances, favor demand for the dollar.

However, geopolitics, which used to support the dollar, can no longer help it. Previously, the dollar would often appreciate during wars, conflicts, and global clashes. But now, the market no longer views the greenback as a "safe haven." Investors, businesses, and major banks increasingly prefer to use other currencies for transactions and reserves. As a result, the euro and/or the pound are now seen as more reliable stores of value. And why not? Both have been appreciating for five consecutive months. The EU and UK economies rank among the top 10 globally.

We do not expect the Fed to provide any support for the dollar on Wednesday evening. What decisions could the Fed make, and what might Jerome Powell announce? A change in the key rate seems unlikely, as Powell often reminds the markets that "you shouldn't count chickens before they're hatched." Donald Trump has failed to sign trade agreements with anyone except the UK, continues to be indecisive about tariff levels, and uses tariffs as a pressure tactic. This means import duties change frequently and are likely to change again in the future. So how can anyone accurately forecast inflation, economic growth, or other key macroeconomic indicators when the baseline constantly shifts?

The dot plot, published quarterly, is also unlikely to differ much from the previous version — for the same reasons. If the market cannot grasp what tariffs and restrictions will ultimately be in place or how many trade deals will be signed, on what basis should monetary committee members alter their outlooks?

As for Powell, he will likely take a cautious stance again, talking about the risks of slowing growth and rising inflation — with the latter positioned as the key barrier to any monetary policy easing. Powell has previously said the Fed would have to intervene if the labor market cools significantly or if economic growth stalls. However, the labor market has shown decent results over the past two months, and Q2 GDP data hasn't been released yet. Even a hint of policy easing in the second half of 2025 will be enough for the market to sell the dollar again. And the dollar has already been falling for five months without such hints. In other words, under any scenario, the outlook is for continued depreciation of the greenback.

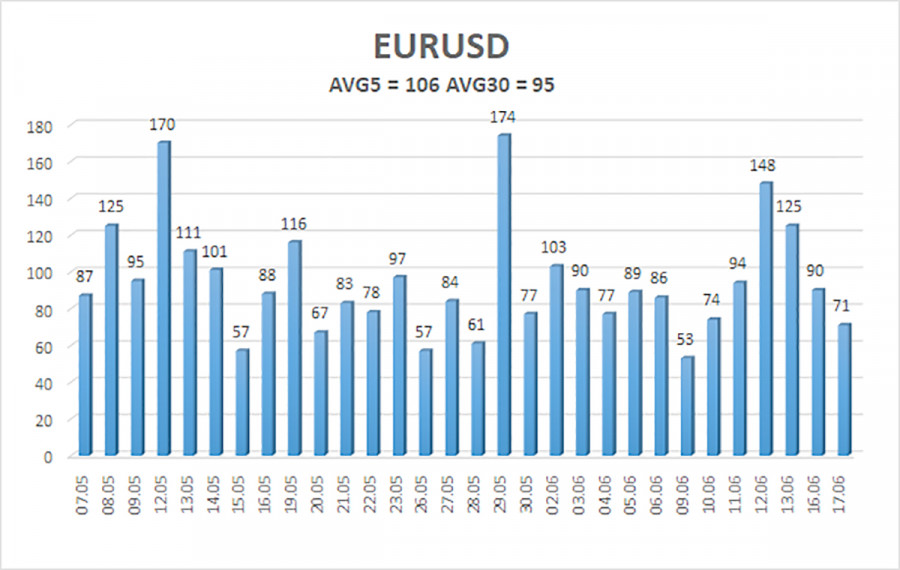

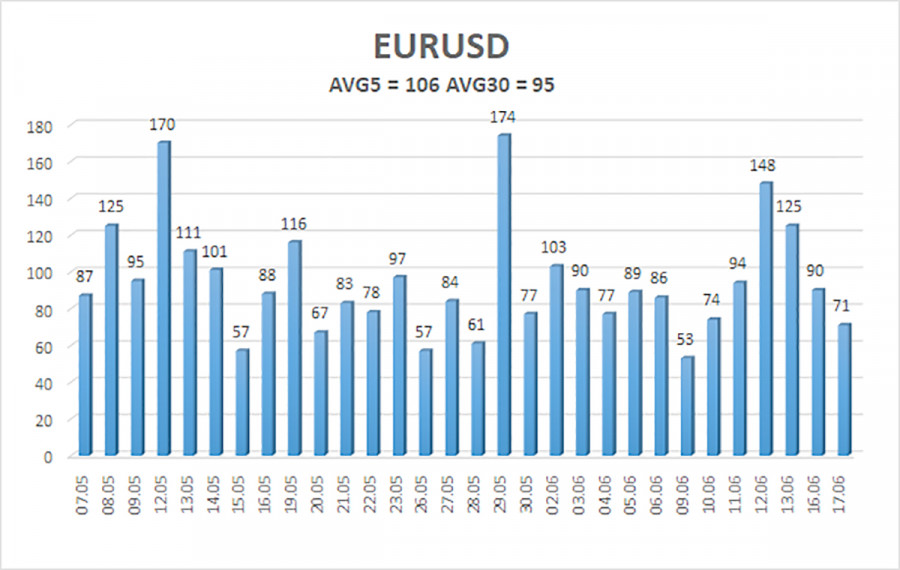

The average volatility of the EUR/USD pair over the last five trading days as of June 18 stands at 106 pips, which is classified as "moderate." We expect the pair to move within the range of 1.1431 to 1.1643 on Wednesday. The long-term regression channel still points upward, indicating a sustained bullish trend. The CCI indicator recently entered the overbought territory, triggering only a minor corrective pullback.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair remains in an upward trend. U.S. political factors, especially those involving Trump, continue to significantly influence the dollar— domestic and international. Moreover, the market often interprets data negatively for the dollar or ignores it altogether. We note the market's complete reluctance to buy the dollar under any circumstances. If the price is below the moving average, short positions with targets at 1.1431 and 1.1353 remain valid, though a strong decline should not be expected under current conditions. If the price is above the moving average, long positions with targets at 1.1597 and 1.1643 are preferable in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.