Analysis of Wednesday's Trades

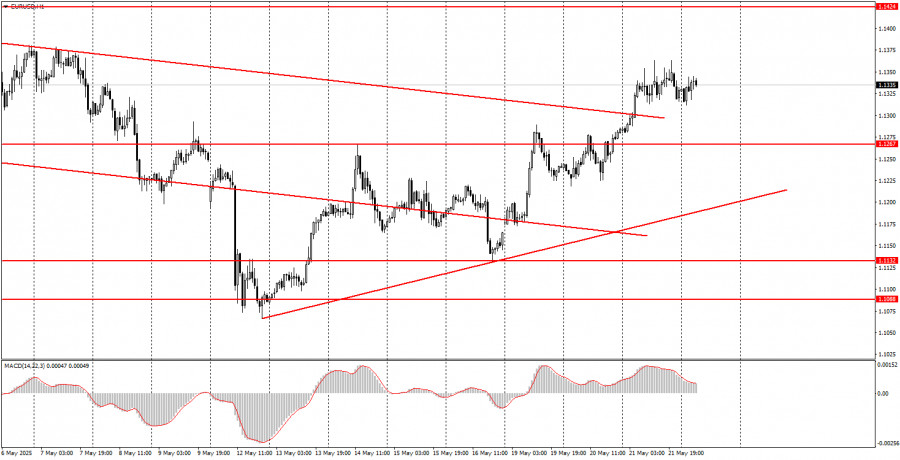

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair continued its upward movement calmly and steadily. The price broke through the 1.1267 level, which it had previously failed to surpass multiple times, and a new ascending trendline was formed. Thus, everything now resembles a resumption of the 4-month-long uptrend sparked by Donald Trump's return. This time, traders didn't have strong reasons to resume selling the U.S. dollar, as Trump hasn't introduced new tariffs or taken decisions threatening the U.S. economy or global stability. On the contrary, the White House has shown signs of de-escalating the trade conflict over the past month, with ongoing trade negotiations and tariff reductions. Nevertheless, as we can see, even this news has not stopped the dollar's sell-off. The market continues to express its sentiment toward the dollar, Trump, and the broader American policy direction through its actions.

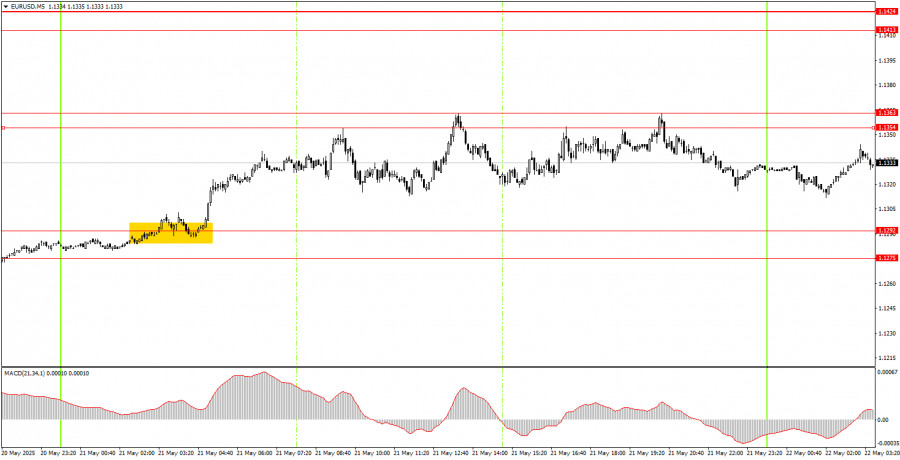

5M Chart of EUR/USD

On Wednesday, a single trading signal was generated on the 5-minute timeframe. During the Asian trading session, the pair broke through the 1.1275–1.1292 area and moved steadily upward throughout the day. The nearest target levels were quite distant, and the 1.1354–1.1363 area was newly established and not present on previous charts. Therefore, the single long position, which could only have been opened at night, could be closed at any point throughout the day and still yield a profit.

Trading Strategy for Thursday:

In the hourly timeframe, the EUR/USD pair has consolidated above the descending channel and continues to rise without any fundamental reasons. It appears that the upward trend that started during Trump's presidency is likely to continue. This time, the market didn't even need new tariffs, sanctions, or other headline-grabbing decisions from Trump. The mere fact that Trump is president appears to be a strong enough reason to sell the dollar under current conditions.

On Thursday, the EUR/USD is anticipated to continue trading based on technical factors. The macroeconomic background still exerts virtually no influence on price movements, and the market once again shows its willingness to sell the dollar with or without a concrete reason.

On the 5-minute timeframe, the following levels should be monitored: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1275–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. Several important releases are scheduled in the Eurozone and the U.S. on Thursday, but are unlikely to alter the overall market sentiment. The dollar may experience a brief uptick, but at this time, there is no indication the market wants to establish a downtrend in EUR/USD. In any case, significant dollar strengthening is unlikely without consolidation below the trendline, even for technical reasons.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.