The GBP/USD currency pair continued its slight decline on Wednesday. The U.S. currency lost nearly 150 points on Monday without any visible reason. Therefore, the 80-point rise over Tuesday and Wednesday looks, to put it mildly, unconvincing. Yesterday, the U.S. released its first estimate of Q1 GDP. Experts expected a significant slowdown in the economy — and they were right. Under Trump, the economy lost about 2% growth in just the first quarter of his presidency. It's also worth noting that, as of now, Trump's tariffs haven't even fully kicked in. Thus, we can quite reasonably expect that things will only get worse.

Meanwhile, Trump summed up his first 100 days at the helm of the U.S., calling this period "great." The U.S. President continues giving interviews and public speeches nearly every day, regularly reminding everyone that he is the ruler of the world, that America has a great future, criticizing Jerome Powell, and talking about the many trade deals that will soon be signed to benefit the economy. However, the market still doesn't believe Trump. It still doesn't.

As we've said before, Trump promises ten times more than he actually delivers. His words often stand in stark contrast to reality. That's why traders and investors don't take him at his word. When the U.S. economy "revives," "becomes great again," then we can be sure that the U.S. dollar will rise, stock markets will recover, and the bond market will be back at its peak. But for now, Trump's words are just words.

It's also worth noting that we still see no clear signs of a de-escalation in the global trade war. Trump has made a few "discounts," promising to lower tariffs for China. But discounts are not trade deals and not the abolition of tariffs. Many experts believe that even if Trump cancels all tariffs tomorrow, he's already inflicted irreparable harm on the U.S. economy. So it's not surprising that the dollar is growing very weakly — and very rarely.

As for the British currency, it is simply reaping the benefits. The British pound hasn't lifted a finger to justify such strong growth. The UK economy itself has faced serious problems in recent years. But for the market, that no longer matters. Of course, traders won't always trade based solely on the "Trump factor." Sooner or later, this narrative will come to an end. But for now, we cannot be sure that it already has.

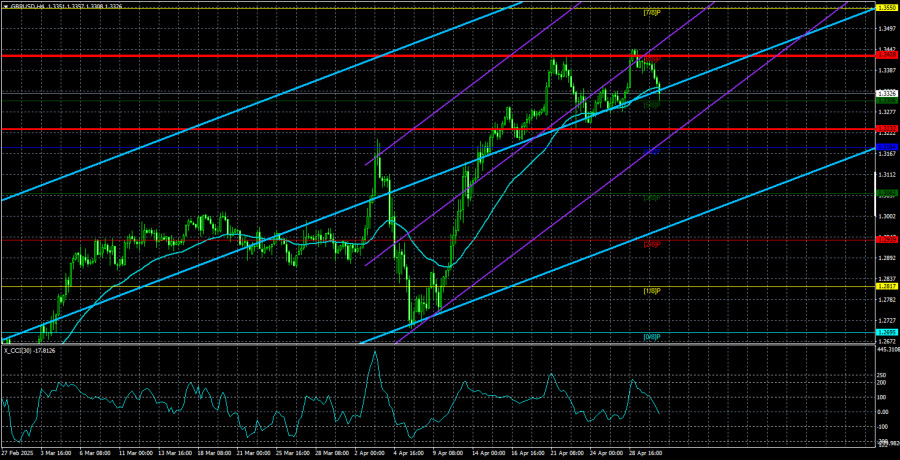

From a technical perspective, on the daily time frame, the pair has reached its September high from last year, but this does not mean the upward movement is over. The trend remains bullish on almost all time frames.

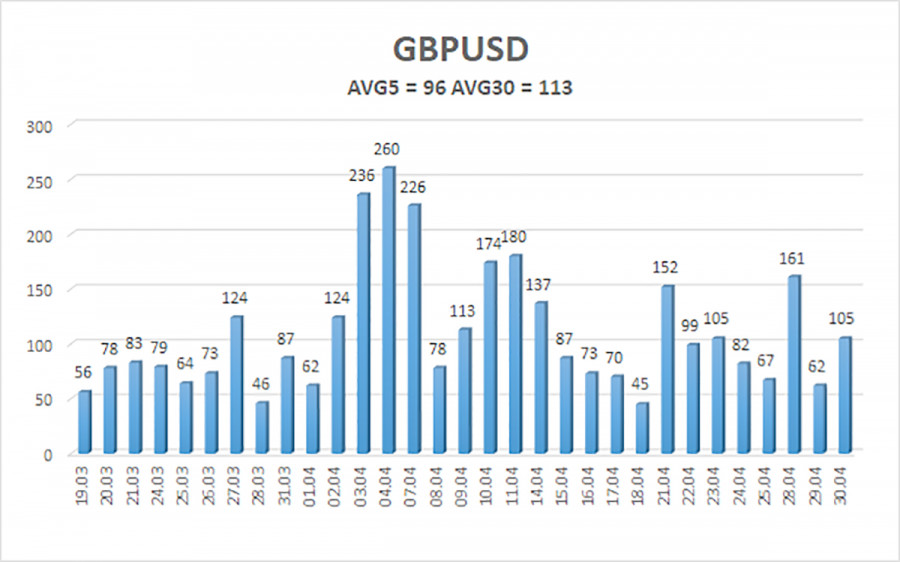

The average volatility of the GBP/USD pair over the last five trading days is 96 points. For the pound/dollar pair, this is classified as "average." Therefore, on Thursday, May 1, we expect movement within a range bounded by the levels of 1.3232 and 1.3424. The senior linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has formed a "bearish" divergence, but in a strong upward trend, these signals typically point to corrections at most.

Nearest support levels:

S1 – 1.3306 S2 – 1.3184 S3 – 1.3062

Nearest resistance levels:

R1 – 1.3428 R2 – 1.3550 R3 – 1.3672

Trading recommendations: The GBP/USD currency pair continues its confident upward movement. We still believe that the pound has no fundamental reasons to rise. It's not that the pound is rising — the dollar is falling. And it's falling solely because of Donald Trump. Therefore, Trump's actions could just as easily trigger a strong downward move. If you trade based on "pure tech" or "on Trump," long positions remain relevant with targets at 1.3428 and 1.3550, as long as the price stays above the moving average. Short positions are still attractive, but for now the market isn't even thinking about buying the U.S. dollar, and Donald Trump continues to provoke new collapses in the greenback.

Explanations for the illustrations:

- Linear regression channels help determine the current trend. If both are pointing in the same direction, the trend is strong.

- The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction for current trading.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the likely price channel within which the pair will trade over the next 24 hours, based on current volatility readings.

- The CCI indicator — a move into the oversold area (below -250) or overbought area (above +250) signals that a trend reversal may be approaching.