On Wednesday, the GBP/USD currency pair managed to avoid a substantial decline, although the day before, it seemed that a downtrend was finally beginning. However, the market quickly bounced back, realizing nothing had changed in the fundamental background. The part concerning central bank monetary policy continues to be ignored by the market. As for Donald Trump, again — nothing has changed. First, Trump said he intended to fire Powell, but he "pardoned" him a few days later. First, Trump promised to end the conflict in Ukraine in 24 hours, then in a month, in 100 days — now the U.S. is ready to walk away from any negotiations. First, Trump imposed tariffs on imports from half the world, then introduced a "tariff amnesty." First, he sets "draconian" tariffs on China, then claims he respects China and that the tariffs won't last long. We could cite countless examples of Trump's flip-flopping rhetoric — these are the most recent and significant ones.

Therefore, the first thing to say is this: if tomorrow Trump cancels all tariffs or decides to keep rates at the minimum level, there's no reason to be surprised. Trump is like a poker player. He tried to bluff — didn't work? Fold the hand. He tried to pretend he had a strong hand — no one believed him? No problem — maybe next time. In other words, Trump is testing the waters globally, trying to get more wherever he can. If he fails — oh well, nothing ventured, nothing gained. Interestingly, many countries have already caught on to Trump's approach. That's why so few take him seriously anymore. Sure, the U.S. can impose tariffs against the EU and China or stop trade altogether, but how does Trump plan to achieve the "great American future"? What will he say to his voters — half who already regret their choice?

The British pound has shown strong growth in recent weeks and months, but this rise could continue for another couple of months or end tomorrow. Everything depends on Trump's unpredictable actions. Economic factors remain irrelevant. Yesterday, the UK published service and manufacturing PMI indexes that came in significantly below expectations, signaling a slowdown in an economy already struggling for the past 2.5 years. Did the pound even drop 20 pips on this data? This was before Trump's tariffs even took full effect!

Chaos continues to reign in the forex market. Making forecasts is pointless — even for a single day, let alone the long term. Two months ago, we had excellent long-term downtrends that looked solid and unshakable. Trump shattered them in an instant.

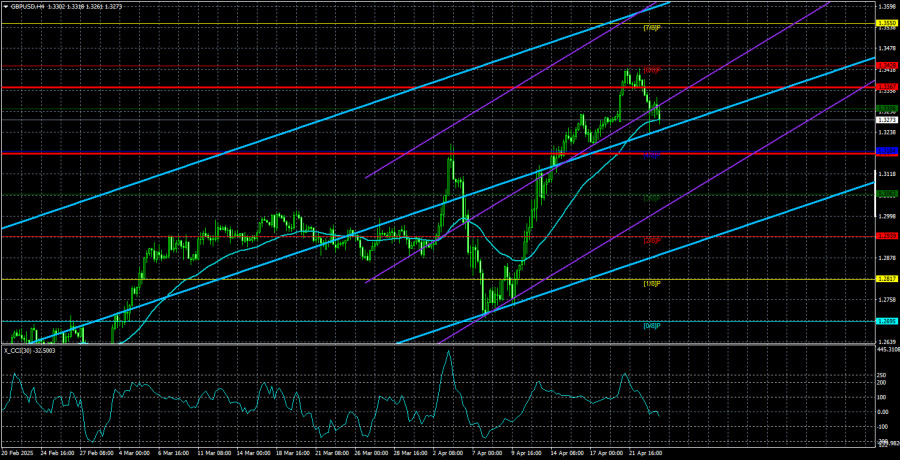

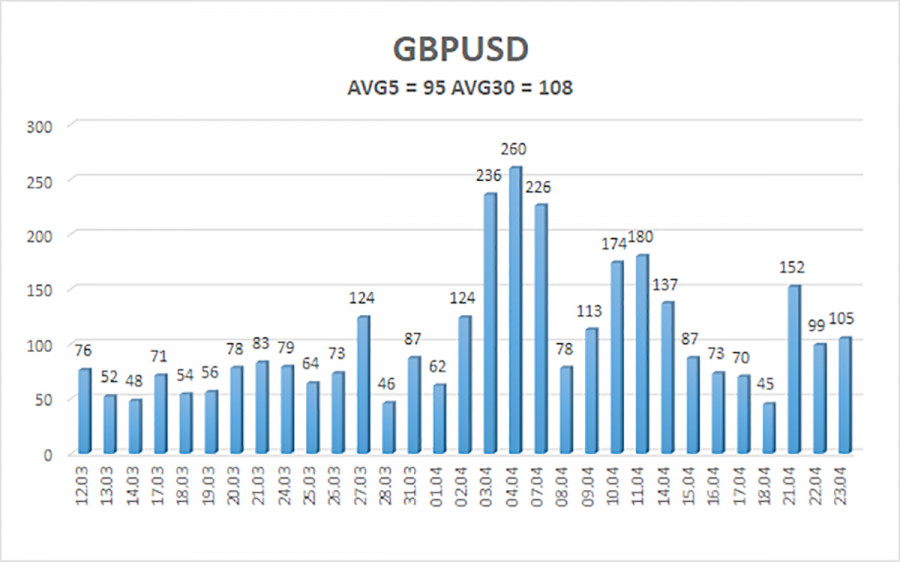

The average volatility of GBP/USD over the last 5 trading days is 95 pips, which is considered "average" for the pair. Therefore, on Thursday, April 24, we expect movement within the range limited by the levels 1.3177 and 1.3367. The long-term regression channel is directed upward, indicating a clear bullish trend. The CCI indicator has again entered the overbought zone, but during a strong uptrend, this usually signals only short-term corrections.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD currency pair continues its confident upward movement. We still believe that the entire rise is a correction of the daily timeframe, which has already taken on an illogical character. However, if you're trading based on "pure technicals" or "Trump effect," long positions remain relevant with targets at 1.3367 and 1.3428, as the price remains above the moving average. Especially since the pound is rising almost daily. Sell orders remain attractive, with targets at 1.2207 and 1.2146, but at the moment, the market isn't even considering buying the U.S. dollar, and Trump continues to trigger new sell-offs in the American currency.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.