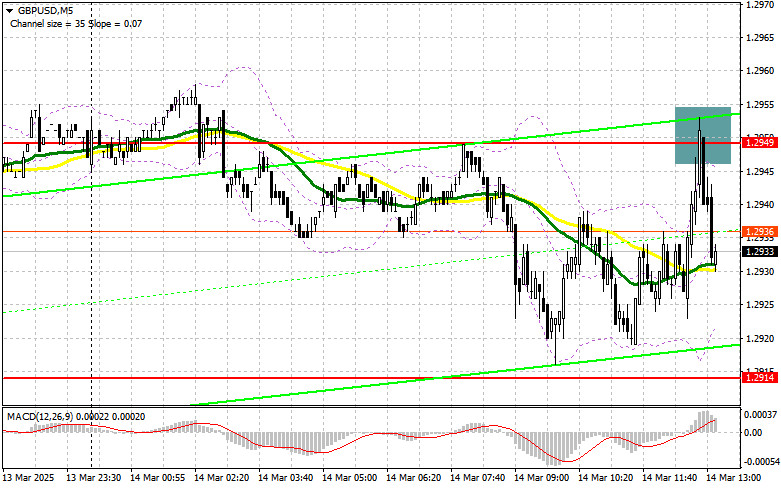

In my morning forecast, I focused on the 1.2949 level and planned to base my trading decisions on it. Let's examine the 5-minute chart to see what happened. A rise followed by a false breakout at 1.2949 provided a good selling opportunity, leading to a 20-point decline in the pair. The technical outlook remains unchanged for the second half of the day.

To Open Long Positions on GBP/USD:

The British pound showed only a slight decline following news that UK GDP contracted in January and came in below economists' expectations. However, this downward move wasn't enough to push the pair out of its trading range, meaning that market focus has now shifted to U.S. data.

The University of Michigan Consumer Sentiment Index and inflation expectations may put pressure on the U.S. dollar if the data comes in weaker than expected, potentially helping GBP/USD continue its upward movement.

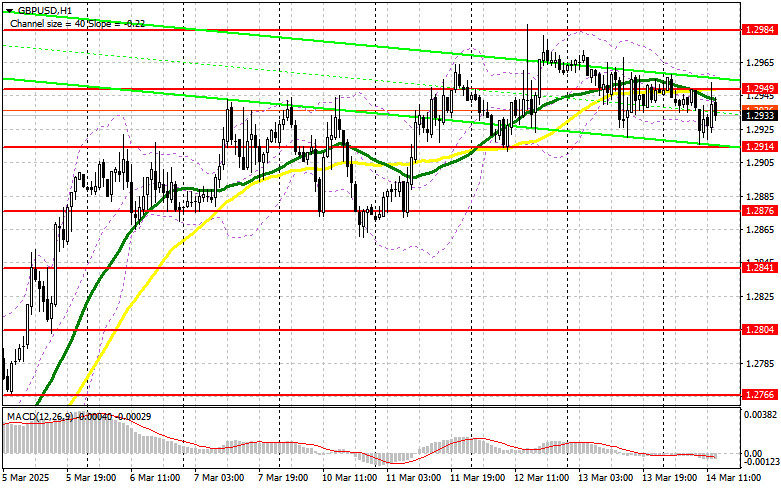

I will stick to the morning scenario and look for buying opportunities from the nearest support at 1.2914. A false breakout at this level will provide a good long entry point, targeting a recovery toward resistance at 1.2949, where the pair is currently trading. A break and retest of this range from above will confirm a strong buy entry, with an upward target of 1.2984, signaling a return to a bullish market. The ultimate target will be 1.3028, where I plan to take profits.

If GBP/USD declines and fails to find buyers around 1.2914, selling pressure on the pound will increase, potentially triggering a stronger sell-off. In this case, I will consider buying only after a false breakout near the 1.2876 low. If the pair drops further, I will open long positions on a rebound from 1.2841, targeting a 30-35 point intraday upward correction.

To Open Short Positions on GBP/USD:

Sellers took advantage of weak GDP data, but even this was not enough to trigger a significant decline, suggesting that there is little interest in selling the pound at current levels.

The main focus in the second half of the day will remain on defending resistance at 1.2949. A false breakout at this level, similar to the morning scenario, will provide a good short entry point, targeting a correction toward 1.2914. A break and retest of this level from below will lead to stop-loss triggers, potentially pushing the pair lower to 1.2876, which would be a significant correction. The ultimate bearish target is 1.2841, where I plan to take profits. A test of this level may temporarily halt the pound's upward trend.

If demand for the pound remains strong in the second half of the day and bears fail to act around 1.2949, I will postpone selling until the next resistance at 1.2984. I will sell only after a false breakout at this level. If there is no downward reaction, I will consider short positions on a rebound from 1.3028, targeting a 30-35 point downward correction.

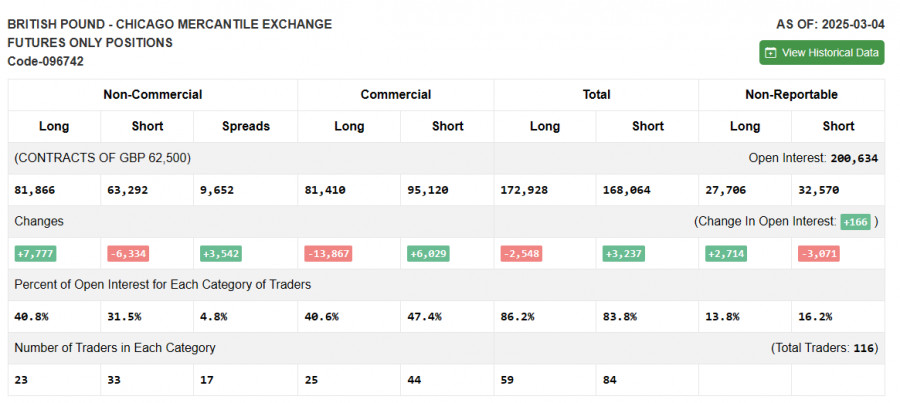

Commitments of Traders (COT) Report:

The COT report for March 4 showed a minimal increase in long positions and a reduction in short positions. The growing dominance of buyers suggests that GBP/USD may continue its upward movement.

Considering positive trends in the UK economy and the Bank of England's gradual approach to rate cuts, the pound may continue to strengthen. However, traders should remain cautious about potential corrections, which could occur before new local highs are reached.

The latest COT report indicated that long non-commercial positions increased by 7,777 to 81,866, while short non-commercial positions declined by 6,334 to 63,292. As a result, the gap between long and short positions widened by 3,542.

Indicator Signals:

Moving Averages:

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Note: The periods and prices of moving averages analyzed by the author are based on the H1 chart and differ from the standard daily moving averages on the D1 chart.

Bollinger Bands:

If GBP/USD declines, the lower boundary of the indicator around 1.2914 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and noise.

- 50-period MA (yellow on the chart)

- 30-period MA (green on the chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands: 20-period

- Non-commercial traders: Speculators, including individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open positions held by non-commercial traders.

- Short non-commercial positions: The total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions among non-commercial traders.