On Monday, the EUR/USD currency pair experienced significant volatility, marked not just by intraday movements but also by a notable gap that formed at the market's opening. We had been anticipating a decline in the euro, a sentiment we have consistently expressed since 2024. Therefore, the sharp drop in the EUR/USD pair did not catch us off guard. However, the extent of the gap observed on Monday evening was unexpected for many. This reaction can largely be attributed to U.S. President Donald Trump's decision to impose tariffs on imports from Mexico, Canada, and China. By Monday, this news had already saturated the media, and a reaction from the market was somewhat anticipated.

What we find puzzling is why the dollar strengthened. Do such tariffs boost the U.S. economy? Do they make it more appealing to investors? Do they increase the demand for American goods? We believe the gap created in the market skewed the technical outlook. The market's reaction seemed impulsive and emotional, with no solid fundamental basis for the dollar's rise on Monday. Moving forward, we expect the gap to close. While we anticipate the U.S. dollar to strengthen in the medium term, we do not expect it to happen through sudden fluctuations, such as a 100-pip drop within two minutes.

The next few days will be challenging to interpret. The market will likely try to close the gap, but this movement is not expected to be driven by fundamental or macroeconomic factors. In other words, even if reports indicate dollar growth, the euro might still rise instead. We believe that, following such a significant drop, the market will need time to stabilize. Additionally, this week is filled with important events and reports in both the Eurozone and the U.S., making it even more difficult to track the market's reaction after such a decline. Essentially, every movement of the pair will raise questions: Is this a response to a new event, or merely a balance adjustment?

Regarding macroeconomic data, the euro had the potential to show growth on Monday. Inflation in the Eurozone unexpectedly accelerated to 2.5% year-on-year, which is above forecasts. Manufacturing PMI indexes in Germany and the U.S. also came in slightly above expectations. However, the significance of these reports is diminished in light of Trump's announcements, his threats toward the European Union, and the 120-pip crash of the euro. To summarize, the market requires time to recover and rebalance prices so we are not left guessing the meaning behind every movement.

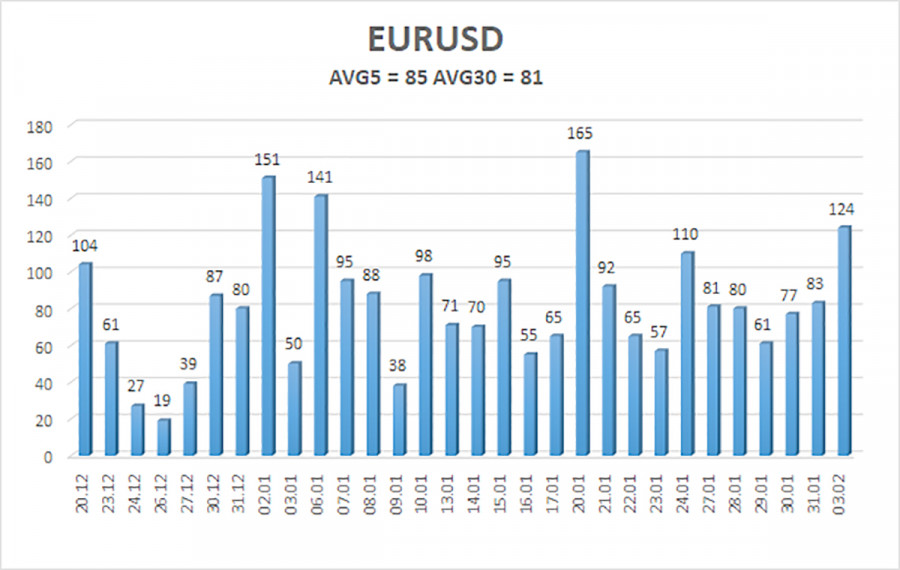

The average volatility of the EUR/USD currency pair over the last five trading days as of February 3 is 85 pips, classified as "average." We expect the pair to move between 1.0200 and 1.0374 on Tuesday. The higher linear regression channel remains downward, and the global bearish trend persists. The CCI indicator entered the oversold area and has since started a new climb from the bottom.

Nearest Support Levels:

- S1 – 1.0254

- S2 – 1.0193

- S3 – 1.0137

Nearest Resistance Levels:

- R1 – 1.0315

- R2 – 1.0376

- R3 – 1.0437

Trading Recommendations:

The EUR/USD pair has sharply resumed its downward movement but quickly retraced back upwards. For the past several months, we have consistently stated that we expect the euro to decline in the medium term, and this outlook remains unchanged. The Federal Reserve has paused its monetary policy easing, while the European Central Bank is accelerating its easing measures. As a result, there are no compelling reasons for the dollar to decline in the medium term, apart from potential technical corrections.

Short positions are still relevant, with targets set at 1.0200 and 1.0193. If you are trading purely based on technical analysis, you might consider long positions if the price remains above the moving average, with targets at 1.0437 and 1.0498. However, it is important to note that any upward movement is still classified as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.